Take a look at these three charts.

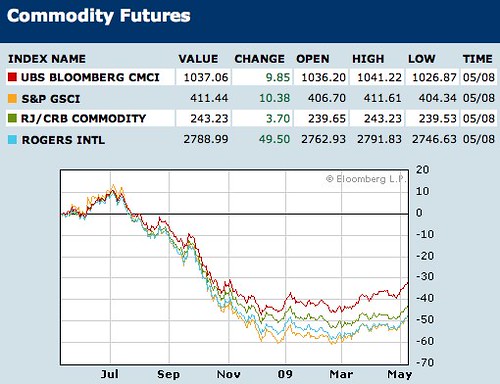

Bloomberg’s commodities index of indices:

Commodities, or commodity futures, are investments in the future value of things like rice, gold, oil, cattle, and other tangible goods.

Baltic Dry Index:

The Baltic Dry Index is an index of costs to ship things on cargo ships. As BDI goes up, the price to ship something goes up. Unlike most investment metrics which are based on future value, BDI measures what it costs now to ship something. BDI is important because you don’t buy shipping if you’re not moving stuff to sell.

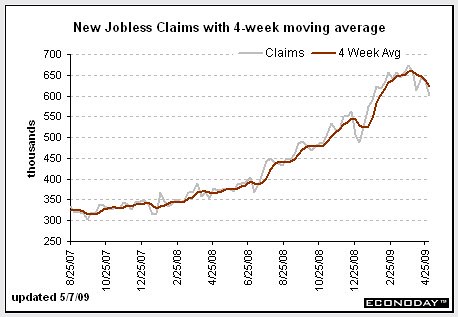

New Jobless Claims:

This is the number of new unemployment claims, measured weekly.

All of these charts show stabilization in the economy – arresting the freefall. Is it because of sound economic policies, stimulus, or the natural course of time and the business cycle? Hard to say. Certainly anyone promoting their own interests will claim that they’re the key influencer, but I suspect it’s all of the above with an emphasis on natural market dynamics. Even the largest forest fire eventually runs out of things to burn and snuffs itself out in time.

Once the fire has passed, it’s time for the forest to regrow. Small, tentative steps at first, little sproutlings and seeds, but regrowth always happens.

I still think there’s other parts of the forest just catching fire now – commercial real estate, credit cards and last-resort consumer credit, etc. – that will burn for some time to come. That said, there is cause for optimism, however cautious. Be on the lookout for areas of regrowth that you can partake in and carefully wade in.

Did you enjoy this blog post? If so, please subscribe right now!

Get this and other great articles from the source at www.ChristopherSPenn.com

Leave a Reply