In an early morning chat from Las Vegas, I was talking with Mr. Waldow about gambling – specifically, blackjack, and how I approach the table. My methodology is fairly simple: I set an amount I’m willing to play with, be it 5 or100. When I step up to the tables, that’s exactly the amount I intend to play with and I will keep it in play as long as I can. When I win, I take the winnings and put them in my pocket, never to see the light of day again. The original bet, whatever size it is, remains in play.

At the end of the session – which admittedly doesn’t last very long, on average about 6 minutes – I walk away. Win or lose, once the original gamble is done, I walk away. If I’ve won 10 or300, I still walk.

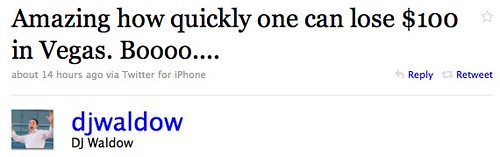

DJ had an interesting take on this:

“Well, that’s why you never win big. You have to play big to win big.”

That’s perhaps true in a system which is fair; casino gambling systems are inherently unfair, and designed to be as unfair as permitted by law. The only way you ever win – big or small – is to garner the favor of luck long enough to win something, and then walk away while you’re still ahead.

It’s absolutely true that I never win big at blackjack, ever. I never lose big, either. In fact, I rarely lose at all (I recommend Darwin Ortiz’s book Casino Gambling for the Clueless (amazon link)

for solid basic blackjack strategy). In the last 6 times I’ve addressed a blackjack table, I’ve walked away with a net profit between 5 and70.

Do you have to play big to win big? In a negative expected value game, if you play big, you win big and lose big, but lose big more often. If you have limited resources – and don’t we all – you will be wiped out by gambler’s ruin. If you play with discipline and accept small wins, all those small wins add up to some tidy profits, tidy big wins.

This is one of the greatest flaws in thinking by humankind, and it pervades every aspect of leisure and business. I’ve lost count of how many people and companies that have completely abandoned solid, working systems in favor of a “play big” bet on things like collateralized debt obligations or social media. Folks spend and squander limited resources to “play big” only to find out that their previous system which accrued small wins was far more reliable.

Consider carefully before you decide to play big. Sometimes it works out.

Other times…

Play to win by being just as accepting of small wins as big wins.

Did you enjoy this blog post? If so, please subscribe right now!

Get this and other great articles from the source at www.ChristopherSPenn.com! Want to take your conference or event to the next level? Book me to speak and get the same quality information on stage as you do on this blog.

Leave a Reply