Social Media and Business Ethics

Prior to my involvement in social media and new media, customers were exactly that – just customers. Rows in a database, indexed by various criteria, points of data making a beautiful line, so to speak. As an online business, my company, the Student Loan Network, never had to really deal with customers all that much, since almost all transactions were digital, almost all were automated, and almost all were without incident. Having a customer base that was a complete commodity also made business decisions relatively easy – send newsletters and notices X number of times a month, accept X percentage unsubscribe rates, calculate X percentage revenue from the clickstream.

To be perfectly candid, we never really had to think about the customer as a human being.

Sure, we said we did, just like everyone else, but if you had asked me off the top of my head to name three customers without opening a SQL command line, I’d have given you a blank look.

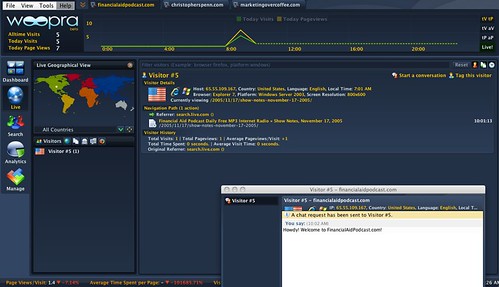

Social media changed all that. From the day I got my first piece of feedback as a podcaster, social media changed how I, and how the Student Loan Network, interacts with its customers. Suddenly, at the other end of the command line output, there were human beings I knew by name, and even call friends. I’ve had lunch with a few.

More importantly, when I go to write a newsletter, a blog post, or an episode of the Financial Aid Podcast, I have to consciously think about what level of quality I’m creating, about what value I’m creating, because it’s no longer just about percentage clicks from the clickstream, it’s about making sure that when Ricky, Fernando, Leah, Nolan, James, and many others get the content I create, they get some value out of it.

Sure, some days will be better than others, but I know that personally knowing customers makes a huge difference in how you approach your business. Being friends with customers radically changes how you do business, because ultimately, if you’re a person of sound ethics and morals, you don’t willfully screw your friends over. It’s the same general concept as requiring the children of elected officials to serve in the infantry of a country’s armed forces – there are real, personal consequences to every decision you make.

This is one of the many upsides of social media – the ability to transform your business into a human enterprise again, if you’re willing to be adventurous and take the risk of letting employees truly and openly communicate with customers and develop real relationships.

I got a hilariously off topic pitch from a PR firm today to the Financial Aid Podcast.

I got a hilariously off topic pitch from a PR firm today to the Financial Aid Podcast.