Matt Mason, author of the Pirate’s Dilemma, pithily says,

Piracy is a market signal.

Piracy indicates that something is sufficiently valuable enough that it’s worth stealing. It’s worth making an illegal copy and spreading without compensating the creator.

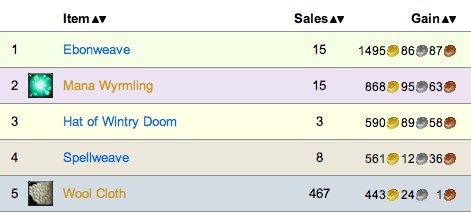

Do you want the most accurate, unbiased, unmanipulated measure of how popular and valuable something is? Go hit up a site like The Pirate Bay or Demonoid or any of the other file sharing services and see if someone is stealing it.

Right now, taking a quick peek, about 150 people are illegally sharing Malcolm Gladwell’s book, The Tipping Point. Another hundred or so are illegally sharing Outliers. Seth Godin’s somewhat less popular, with about 30 people sharing Purple Cow and Permission Marketing. A dozen are legally sharing Seth’s eBooks, which are free on his web site as well.

Matthew Ebel, independent musician, noted that recently there have been inquiries on Yahoo Answers about people trying to illegally share his music. By the way, Matthew, your 2005 album Beer and Coffee is being shared by at least two people illegally on Bit Torrent, just so you know. Go post a comment in that thread on the Pirate Bay.

Unlike commercial markets where marketers spend time, energy, and money to get you to buy things, no commercial marketer actively goes out and tells people to steal their products and not pay them. That’s completely irrational.

Give away for non-monetary currency, sure, through inbound links or reputation, through legitimate venues like your web site or iTunes, but no one wants to confer any level of legitimacy on pirate markets. Thus, when you see something in a pirate market that is actively being traded (meaning someone right now is seeding or leeching, uploading or downloading), it’s a good indicator to me that there’s value being exchanged, even if the creator isn’t getting compensated.

By the way, the distinction about active trading is important – you can upload your eBooks for free in pirate markets as well, but no one can force traders to download it or share it. If it’s in active trade, someone thinks they’re enough value there.

Believe it or not, in some ways, this is a good thing. This is an indicator that people care enough about what you have for sale that they’re willing to steal it, to share it illegally. Granted, especially for an independent musician, there’s a very real consequence of people not paying for your stuff (food and rent don’t get paid with hugs), but at least it’s a market signal that your stuff has enough value to warrant stealing in the first place.

So as a content creator, is your stuff worth stealing? Is anyone stealing it right now?

If not, it might be a market signal that you need to up your game to steal-worthy!

Did you enjoy this blog post? If so, please subscribe right now!

Enjoyed it? Please share it!

Get this and other great articles from the source at www.ChristopherSPenn.com